Jingdong Industrials Is Said to Price Hong Kong IPO in Middle of Marketed Range

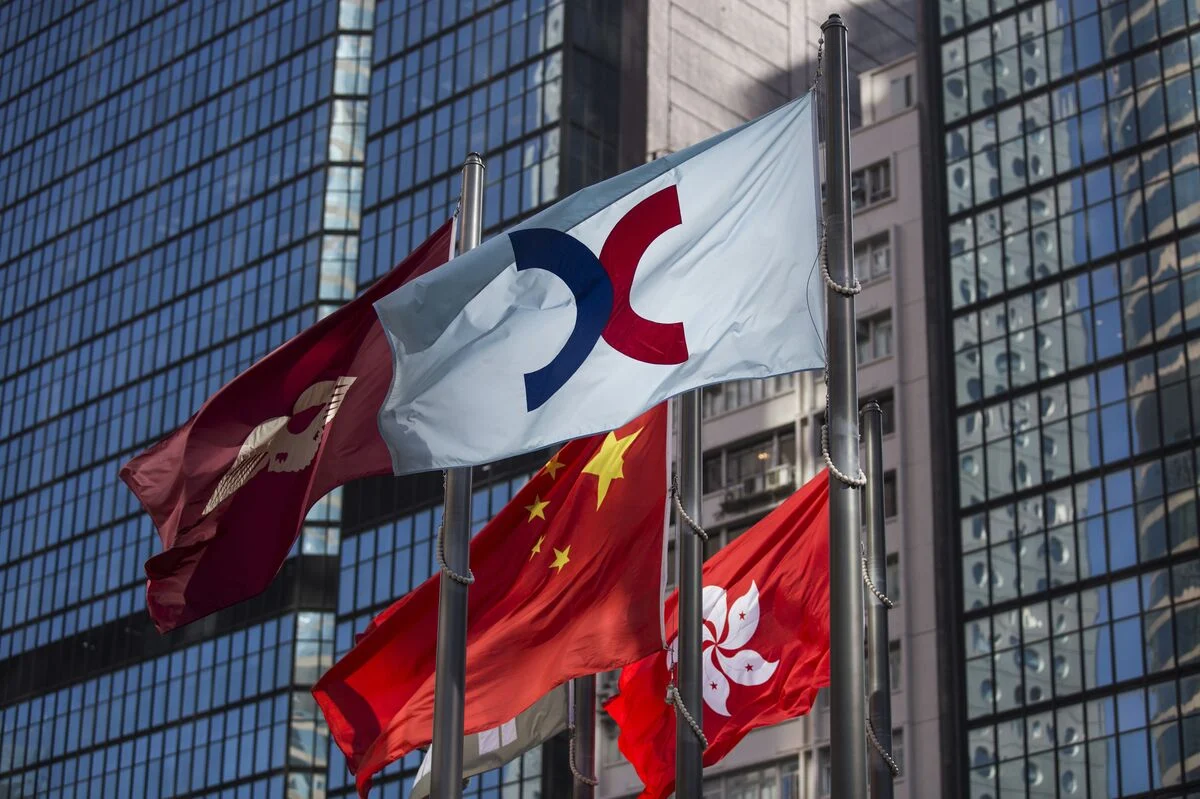

Jingdong Industrials is said to have priced its initial public offering (IPO) in Hong Kong at the midpoint of its marketed range. The supply-chain technology unit of JD.com Inc. successfully raised HK$2.98 billion, which is approximately $383 million. This pricing decision reflects the company’s strategic approach to entering the Hong Kong market.

The IPO pricing at the middle of the marketed range indicates a balanced investor demand and market conditions. By setting the price at this level, Jingdong Industrials aimed to attract a broad base of investors while ensuring a stable valuation. This approach often helps companies achieve a successful listing without overpricing or undervaluing their shares.

Details of Jingdong Industrials’ Hong Kong IPO Pricing

According to sources familiar with the matter, Jingdong Industrials’ IPO pricing was carefully determined to fall within the marketed range. The company’s supply-chain technology unit, which operates under JD.com Inc., managed to raise nearly HK$3 billion through this offering. The amount raised, HK$2.98 billion, translates to about $383 million in U.S. dollars.

This fundraising effort marks a significant step for Jingdong Industrials as it expands its presence in the financial markets. The decision to price the IPO in the middle of the marketed range suggests that the company balanced its valuation expectations with investor appetite. It also reflects a cautious yet confident approach to entering the competitive Hong Kong stock market.

Implications of Jingdong Industrials’ IPO Pricing Strategy

Jingdong Industrials is said to have taken a measured approach by pricing its Hong Kong IPO at the midpoint of the marketed range. This strategy often signals a desire to maintain market stability and investor confidence. By not pushing the price too high or too low, the company positions itself for a smoother market debut.

The HK$2.98 billion raised through this IPO will likely support Jingdong Industrials’ growth and development in the supply-chain technology sector. As a unit of JD.com Inc., the company benefits from strong backing and a solid business foundation. The successful pricing of the IPO in the middle of the marketed range highlights Jingdong Industrials’ careful planning and market understanding.

In summary, Jingdong Industrials is said to have priced its Hong Kong IPO at the midpoint of the marketed range, raising HK$2.98 billion ($383 million). This pricing strategy reflects a balanced approach to market entry, aiming to attract investors while maintaining a stable valuation. The funds raised will support the company’s ongoing growth as a key player in supply-chain technology under the JD.com Inc. umbrella.

For more stories on this topic, visit our category page.

Source: original article.