Bitcoin Options Show Traders Preparing for Continued Market Stagnation

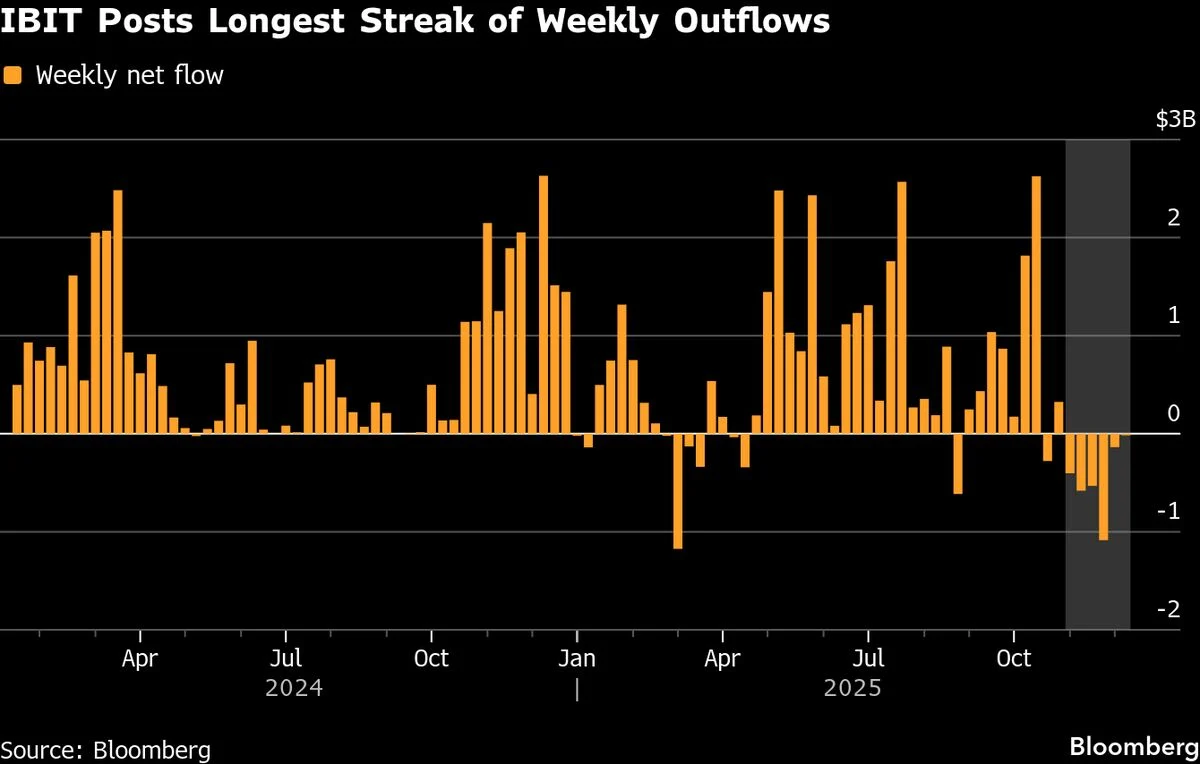

Bitcoin options data reveal that traders expect the largest cryptocurrency to stay stuck within its current trading range. This sentiment follows a significant downturn in the fourth quarter, which wiped out more than $1 trillion in value from the digital asset market. Investors appear to be bracing for a prolonged period of limited price movement rather than a swift recovery or further sharp declines.

The recent drop in bitcoin’s value has left many market participants cautious. Rather than betting on a rebound or a crash, traders are positioning themselves for continued sideways trading. This cautious stance is reflected in the bitcoin options market, where contracts are being structured to benefit from stability rather than volatility.

Understanding How Bitcoin Options Show Traders’ Market Expectations

Bitcoin options provide insight into how traders view the future price action of the cryptocurrency. These financial instruments allow investors to speculate on or hedge against price changes. When options activity indicates a preference for contracts that profit from little price movement, it suggests that traders anticipate a period of consolidation.

The current bitcoin options activity points to a market consensus that the cryptocurrency will remain range-bound. This means that traders expect bitcoin’s price to fluctuate within a relatively narrow band, without significant upward or downward swings. Such expectations often emerge after a major market correction, as investors wait for clearer signals before committing to new positions.

Implications of Bitcoin Options Show Traders Bracing for Crypto Winter

The fact that bitcoin options show traders preparing for a stagnant market highlights a broader mood of caution in the crypto space. The fourth-quarter downturn erased a massive amount of value, shaking investor confidence. As a result, many traders are hunkering down, adopting strategies that protect them from further losses while limiting exposure to volatility.

This defensive approach in the bitcoin options market suggests that the crypto winter may persist for some time. Traders are not rushing to buy or sell aggressively; instead, they are focusing on managing risk amid uncertainty. The market’s current state reflects a wait-and-see attitude, with participants ready to respond once clearer trends emerge.

In summary, bitcoin options show traders are positioning themselves for continued stability in the cryptocurrency’s price. After a severe market decline, investors are cautious and expect bitcoin to remain within its current trading range. This outlook underscores a period of consolidation and risk management as the crypto market navigates ongoing challenges.

For more stories on this topic, visit our category page.

Source: original article.