SoftBank in Talks to Acquire Data-Center Investor DigitalBridge

SoftBank in Talks to Buy Data-Center Investor DigitalBridge

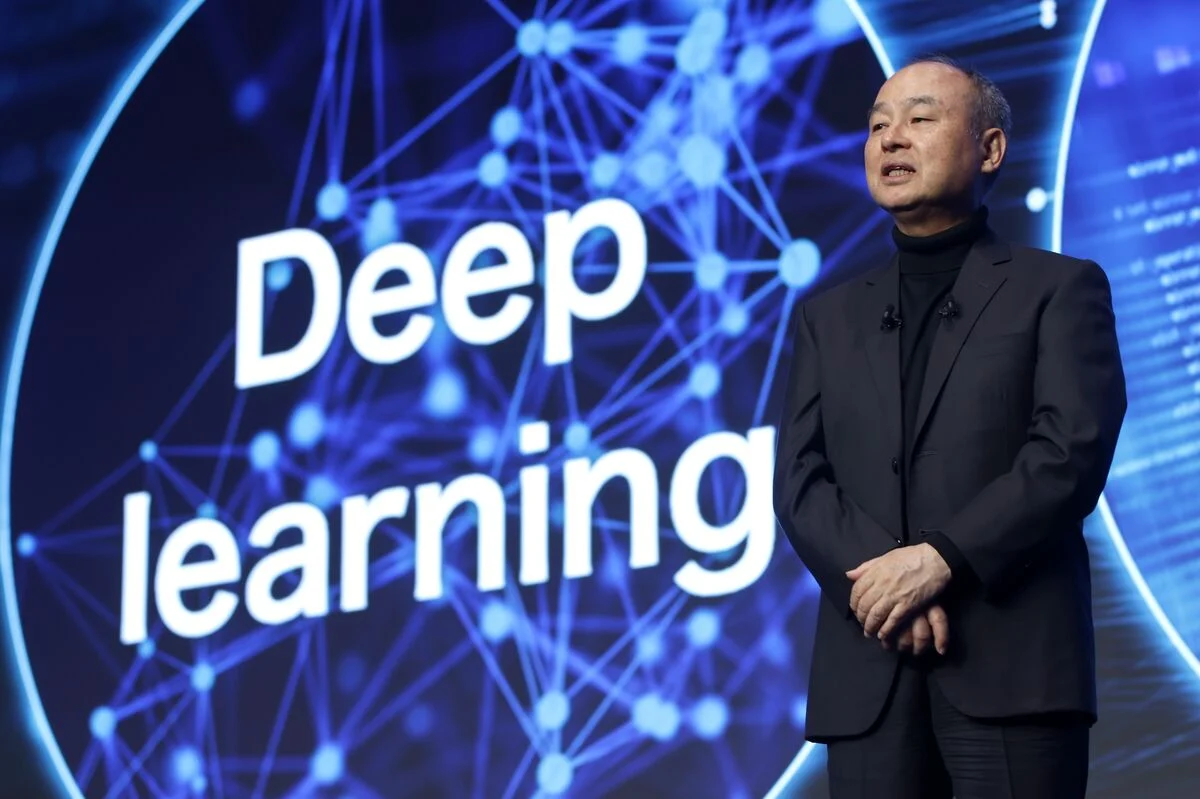

SoftBank Group Corp. is currently in discussions to acquire DigitalBridge Group Inc., a private equity firm specializing in investments in data centers and other digital infrastructure assets. This move comes as SoftBank aims to capitalize on the growing demand for digital infrastructure driven by advancements in artificial intelligence. Sources familiar with the matter have confirmed that these talks are underway.

SoftBank’s interest in DigitalBridge highlights its strategic focus on expanding its footprint in the digital infrastructure sector. DigitalBridge is known for its investments in data centers, which are critical components supporting the increasing reliance on cloud computing, AI technologies, and digital services. By acquiring DigitalBridge, SoftBank would strengthen its position in this rapidly evolving market.

The AI-driven boom in digital infrastructure has created significant opportunities for companies that own and operate data centers. These facilities provide the essential hardware and connectivity needed to support AI applications and large-scale data processing. SoftBank’s pursuit of DigitalBridge reflects its intent to leverage this trend and enhance its portfolio in the technology and infrastructure space.

SoftBank in Talks to Expand Digital Infrastructure Portfolio

The ongoing talks between SoftBank and DigitalBridge underscore SoftBank’s commitment to investing in sectors that benefit from technological innovation. DigitalBridge’s expertise in managing data-center assets aligns well with SoftBank’s broader strategy to focus on digital infrastructure, which is increasingly vital in the AI era.

Data centers play a pivotal role in the digital economy by hosting servers and networking equipment that enable cloud services and AI workloads. DigitalBridge’s investments in these assets make it an attractive target for SoftBank, which is looking to deepen its involvement in the infrastructure that supports next-generation technologies.

By acquiring DigitalBridge, SoftBank would gain access to a portfolio of data-center assets that are positioned to benefit from the surge in AI-related demand. This acquisition would allow SoftBank to participate more directly in the growth of digital infrastructure, which is essential for the continued expansion of AI and other digital services.

Strategic Implications of SoftBank’s Interest in DigitalBridge

SoftBank’s talks to acquire DigitalBridge reflect a broader trend of investment in digital infrastructure driven by the rise of AI technologies. As AI applications become more widespread, the need for robust data-center capacity grows, making companies like DigitalBridge valuable partners or acquisition targets.

The potential acquisition would enable SoftBank to strengthen its position in the digital infrastructure market, providing it with greater control over key assets that support AI and cloud computing. This aligns with SoftBank’s goal of leveraging technological advancements to drive growth and create value for its investors.

In summary, SoftBank is in talks to acquire DigitalBridge Group Inc., a private equity firm focused on data centers and digital infrastructure. This move is part of SoftBank’s strategy to benefit from the AI-driven boom in digital infrastructure by expanding its portfolio with assets that are critical to supporting AI and digital services. The acquisition would enhance SoftBank’s presence in this important sector and position it for future growth in the technology infrastructure space.

For more stories on this topic, visit our category page.

Source: original article.