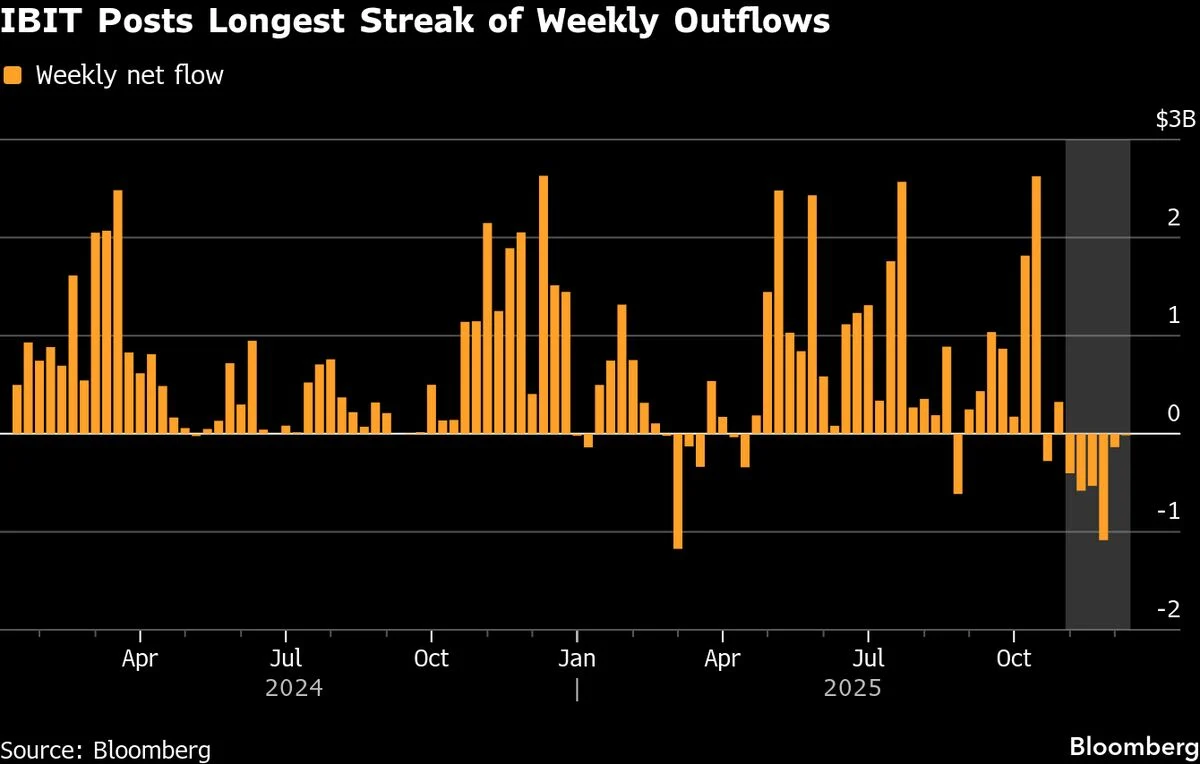

BlackRock Bitcoin ETF Sheds $2.7 Billion in Record Outflows

BlackRock Inc.’s iShares Bitcoin Trust has experienced its longest consecutive weekly withdrawals since its launch in January 2024. This trend highlights a continued lack of strong institutional interest in the world’s largest cryptocurrency, despite recent price stabilization. The fund has seen a significant outflow of $2.7 billion, marking a record level of withdrawals for the BlackRock Bitcoin ETF.

The sustained outflows suggest that investors remain cautious about committing capital to Bitcoin through this particular exchange-traded fund. Even though Bitcoin prices have steadied, the appetite among institutional investors to increase their exposure appears limited. The BlackRock Bitcoin ETF sheds assets at a pace not seen since its debut, indicating a persistent hesitancy in the market.

Institutional Interest Remains Subdued Despite Price Stability

The iShares Bitcoin Trust’s ongoing withdrawals reflect a broader trend of subdued institutional demand for Bitcoin. While the cryptocurrency’s price has stabilized, this has not translated into renewed confidence or increased investment from large-scale investors. The BlackRock Bitcoin ETF sheds billions in assets, underscoring the cautious stance many institutions are taking.

This pattern of outflows over multiple weeks points to a reluctance among institutional investors to commit fresh funds to Bitcoin through this vehicle. The ETF’s performance in terms of asset inflows and outflows serves as a barometer for institutional sentiment, which currently appears muted. The record outflows highlight the challenges the BlackRock Bitcoin ETF faces in attracting and retaining institutional capital.

Implications of the BlackRock Bitcoin ETF Sheds on Market Sentiment

The record withdrawals from BlackRock’s iShares Bitcoin Trust have important implications for the cryptocurrency market. The BlackRock Bitcoin ETF sheds $2.7 billion, signaling that even with price stability, institutional investors remain cautious. This sustained lack of inflows could affect the broader perception of Bitcoin’s appeal as an investment asset.

The ETF’s outflows may reflect concerns about market volatility or uncertainty about Bitcoin’s long-term prospects. Despite the fund’s backing by a major asset manager like BlackRock, the ongoing withdrawals suggest that institutional investors are not yet convinced to increase their Bitcoin holdings. The BlackRock Bitcoin ETF sheds assets at a record pace, emphasizing the current subdued demand in the institutional segment.

In summary, BlackRock’s iShares Bitcoin Trust is witnessing its longest streak of weekly withdrawals since its inception. The fund has lost $2.7 billion in assets, indicating a cautious institutional approach to Bitcoin investments. Even as prices stabilize, the BlackRock Bitcoin ETF sheds assets, underscoring the subdued appetite among large investors for the world’s largest cryptocurrency.

For more stories on this topic, visit our category page.

Source: original article.