Nvidia Corp. released a forecast that was expected to encourage dip buyers to return to the market. However, instead of sparking renewed confidence, the day saw a sharp decline in technology stocks. This downturn, combined with a mixed jobs report, left investors feeling shaken and uncertain about their next move.

The strong forecast from Nvidia was anticipated to act as a catalyst for investors looking to buy on market dips. Many hoped it would signal a rebound in the tech sector and provide a reason to re-enter the market. Yet, the opposite occurred. The technology sector experienced a significant sell-off, undermining the optimism that Nvidia’s forecast had initially generated.

At the same time, the jobs report released was mixed in nature. It did not provide a clear signal about the health of the labor market or the broader economy. This ambiguity added to the unease among investors, who were already dealing with the pressure from the tech sell-off. The combination of these factors created a challenging environment for market participants.

Investors found themselves at a crossroads. On one hand, they could choose to step back and nurse their wounds after the harsh trading day. The losses and uncertainty made it tempting to pause and reassess their positions. On the other hand, some might consider wading back into the market, hoping to take advantage of lower prices or to position themselves for a potential recovery.

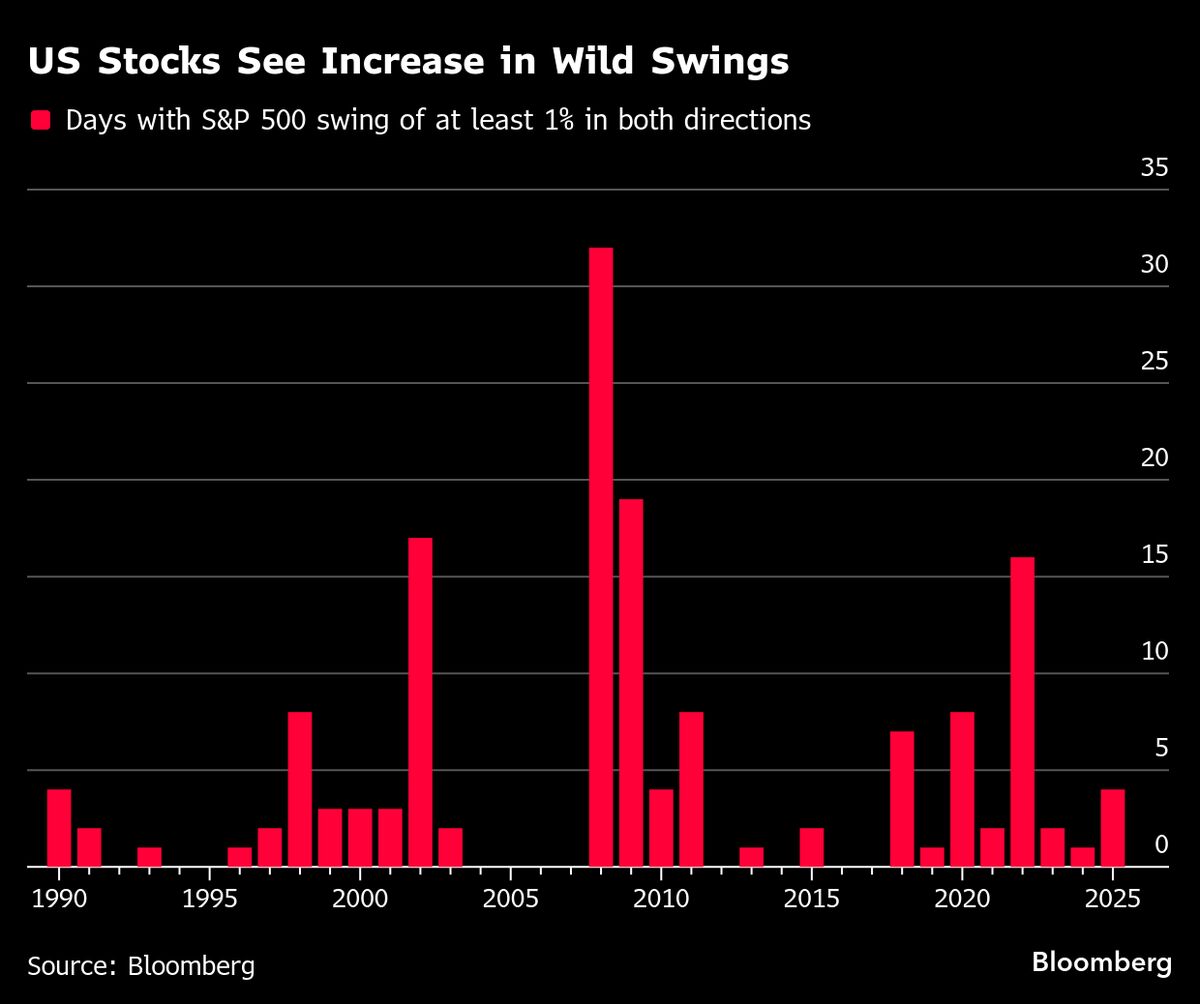

The day’s trading was one of the wildest since the shock caused by tariffs. Such volatility tested the nerve of dip buyers, who typically look for opportunities to buy when prices fall. The intensity of the sell-off and the mixed economic signals made it difficult to determine whether this was a buying opportunity or a sign of further trouble ahead.

In summary, Nvidia’s upbeat forecast failed to revive confidence among dip buyers. Instead, a sharp decline in technology stocks and an unclear jobs report left investors battered and uncertain. They faced a tough decision: to hold back and recover from losses or to re-enter the market despite the risks. The trading day highlighted the challenges investors face in navigating volatile markets, especially when positive news is overshadowed by broader concerns.